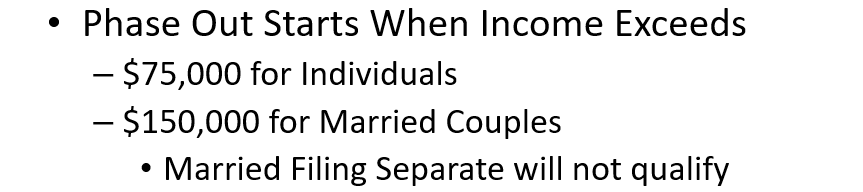

$6,000 for one Individual

$12,000 if Married Couple are both over 65

•Seniors – 65 and over

•Applies for tax years 2025 through 2028 (temporary provision)

•Must have a valid Social Security Number

•Senior Deduction is separate from the Additional Standard Deduction of $2,000/$1600 for 65+ years old.

A Married Couple (both over 65) can pay no tax on the first $46,700 of taxable income!