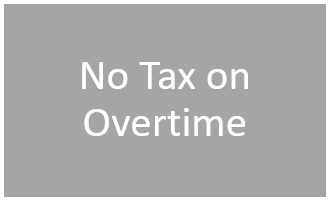

$12,500 for Individuals

$25,000 for Married Couples

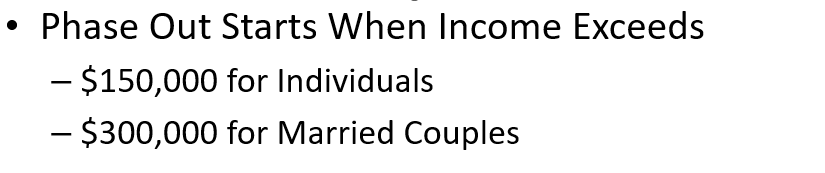

•Who Qualifies: W‑2 employees (not independent contractors) earning overtime that meets FLSA rules. Example: “time‑and‑a‑half” for hours over 40/week

•Who Doesn't Qualify: Owners of the Business or Corporation

•Deduction Limit: Only the premium portion of overtime counts—the extra pay above your regular rate.

Example: $20/hr regular → $30/hr overtime → $10/hr qualifies

Example: $20/hr regular → $30/hr overtime → $10/hr qualifies

•Employers must provide a statement or include an entry on W-2 Form

•MFJ - The $25,000 is can be combined. It is not $12,500 per spouse limit